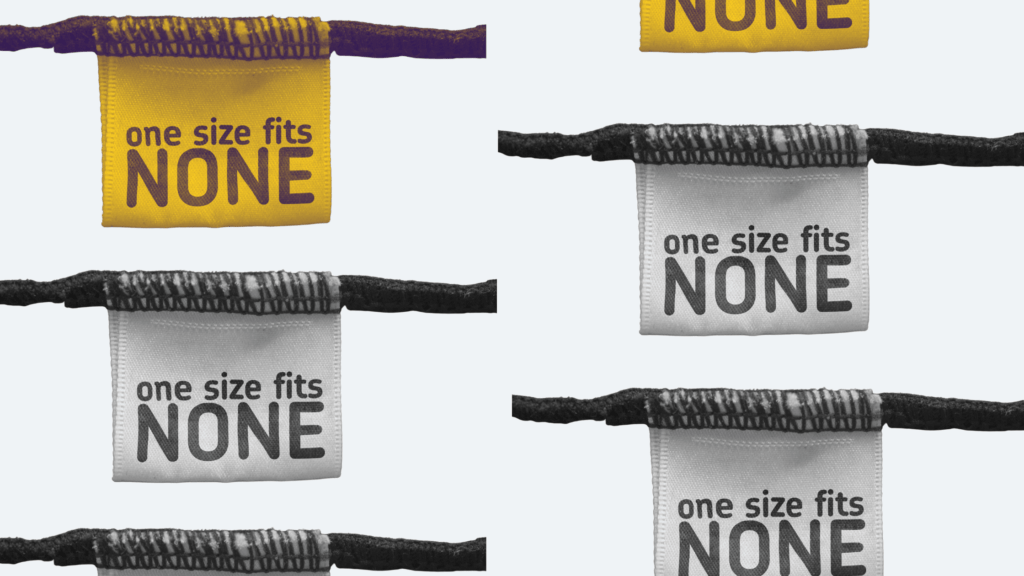

Neoliberalism always promised the world freedom – the freedom of unfettered markets, property rights, and entrepreneurial self-ownership. A fierce embrace of individualism was posited as the cornerstone of the liberal regime, allowing autonomy and creativity to flourish. However, this now globalized ideology tends toward absolutism – advocating a one-size-fits-all solution for shared prosperity. It unequivocally pushes for unbounded deregulation, privatization and liberalization, and a reduced welfare state. It does so with reckless abandon, and with little regard for the diverse socio-economic and historical realities of developing nations. More often than not, it ends up curtailing the very freedom that it seeks to expand. The structural embodiments of this ideology are glaring. Institutions like the International Monetary Fund (IMF) offer loans to developing countries, conditional upon the implementation of fiscal austerity. The recommended policies include cuts to the public budget, particularly social protection, privatization of state-owned enterprises and public services and goods, the introduction of regressive taxation systems, and contractionary monetary policy that increases interest rates. Most developing countries are already vulnerable, their economic resilience eroded by centuries of colonialization and exploitation. There is an existing structural dependency on external debt. It becomes easy to push through neoliberal reforms when political leaders are operating from a place of desperation. The IMF is cognisant of this power asymmetry and heavy-handedly promotes a system of fiscal consolidation that leaves social protection as a mere afterthought.

Empirical, data-based evidence has demonstrated the failed outcomes of austerity measures – structural inequalities, erosion of basic public services, and social fissures (Madowitz, 2014). Beyond obvious impacts, it is important to note that macroeconomic policy (in the form of harsh austerity) is not gender-neutral. Market societies tend to reproduce existing gender inequalities and, in fact, reinforce them. Unequal power relations between men and women and the gender division of labor (i.e., women’s unpaid “reproductive” and subsistence labor and men’s “productive”, income-generating labor) have translated into different impacts of macroeconomic policies. First, cuts in social spending expenditures affect women more. The government’s failure to fund public (health, educational, and social) provisions and the consequent privatization of public utilities and services transfers the responsibility to households. Owing to cultural setups and normative gender norms, the burden falls on the women of the household, who are expected to contribute more to unpaid care services within the household. This can look like increased home care for sick family members. Simultaneously, women are also expected to supplement family income through longer working hours, usually in low-paying informal sector jobs. Women often struggle to balance dual roles, affecting their efficiency in both domestic and market spheres. Increased user fees for services previously provided for free or at minimal costs, such as school tuition, uniforms, textbooks, etc., lead to adverse educational outcomes for girls. They are pulled out of school before boys when households cannot afford school fees for multiple children. Restricted access to education creates intergenerational cycles of poverty based on gender. Over the past two decades, country and region-level empirical research have confirmed the adverse impact of IMF policy conditions on the secondary school enrolment of girls.

The government’s reduction of public expenditures and adoption of privatization policies doesn’t just add to the unpaid labor borne by women but also leads to a downsizing of the public sector. Policy-based loans require decreased government spending on public sector employees, leading to massive layoffs. A disproportionate number of women are laid off, largely due to a “breadwinner bias” (Das, 2015). Men are perceived as the primary breadwinners that provide for various independents in the non-market reproduction sphere, relegating women to the status of “secondary breadwinners” or worse, entirely dependent on the male breadwinner’s income. Women are the first to be fired and the last to be rehired, leaving them grappling for low-paying, bottom-of-the-rung job opportunities in the informal sector. A widening wage gap between men and women only cements economic dependence and pits women against each other for the limited formal sector jobs that remain. The combination of reduced government expenditures and privatization policies means that women are expected to work more and work harder, but in unsafe, low-paying, and precarious jobs. There is truly no upside.

Further, the exclusive focus of governments on controlling inflation through tight monetary policy also ends up hurting women. Faced with rising interest rates, women with limited or no access to collateral find it difficult to secure loans to establish/run small-scale enterprises. Constricted by dismal pay, held back by an inconducive business environment, and with minimal access to social security, women find themselves financially dependent on men. They often end up staying in abusive households and suffer from increased risks of sexual violence. Faced with few alternatives, girls and women undertake sex work, a highly unregulated industry that offers little protection against unbridled exploitation. Quite conclusively, there is an overall deterioration of gender outcomes across multiple measurable dimensions such as health, education, and social protection.

For women in the Global South, neoliberalism did not deliver on its promise of freedom. It merely stifled them. However, the IMF continues to extend conditional loans, as seen in the Covid-19 era. In 2021, 13 out of 15 loan programs negotiated with low-income countries such as Sudan, Kenya, and Senegal required the imposition of austerity measures (Oxfam International, 2022). Is there any upside? Proponents of IMF’s conditional lending programs frame the consequences of non-intervention as benefits of IMF financing. Without the IMF, developing countries would have no choice but to adjust – often through a difficult and painful contraction of imports and economic activity that would destabilize the economy and lead to massive civil unrest. This completely disregards the viability of alternatives. Financing options such as implementing progressive taxation systems, tapping into fiscal and foreign exchange reserves, and managing debt can be explored. Proponents of conditionality also point towards the economy’s increased openness and export orientation as a net advantage. A trade-liberalized economy leads to a higher female ratio of workers in the labor force since the economy is specialized in low-skill, labor-intensive industries, dominated by women. However, this is true only for the initial stages of development. At later stages of development, male-dominated, technology-intensive industries prevail, leading to a de-feminization of labor.

Any attempt at justifying the IMF’s conditional loan program falls flat. It is simply ineffectual, inefficient, and mistargeted. The policy prescriptions that accompany IMF programs come at significant economic and social costs and do not enable governments to live up to the moral duties they owe their citizens. Gender-blind orthodox policies that do not allow for the recognition of the differential impacts of austerity measures cannot remain the norm. There is a responsibility to rethink overarching frameworks that have pushed exploitation for decades. We must seize opportunities to rethink debt servicing and sustainability beyond the narrow strictures of what was possible and towards what can be possible.

References

Das, S. (2015). Growing Informality, Gender Equality and the Role of Fiscal Policy in the Face of the Current Economic Crisis. International Journal of Political Economy , 277-295.

Madowitz, M. (2014, May 30). What Have We Learned About Austerity Since the Great Recession? Retrieved from American Progress : https://www.americanprogress.org/article/what-have-we-learned-about-austerity-since-the-great-recession/

Oxfam International. (2022, April 19). IMF must abandon demands for austerity as cost-of-living crisis drives up hunger and poverty worldwide. Retrieved from Oxfam International: https://www.oxfam.org/en/press-releases/imf-must-abandon-demands-austerity-cost-living-crisis-drives-hunger-and-poverty