LEDE: Coherent vision, reformed processes and accessible products in financial education will create money-smart individuals.

Among the many critical skills which are fundamental for a fulfilling life but are still largely outside the ambit of our education system, financial literacy must rank at the top. More often than not, we learn concepts like saving, budgeting and wealth creation through informal channels like our parents. Worse still, misinformation could turn young adults into financial profligates. A survey by the National Centre for Financial Education (NCFE) states that only 27% of the adults in India are financially literate. Hence, there is a strong case for institutionalizing financial education (FE) in our schools.

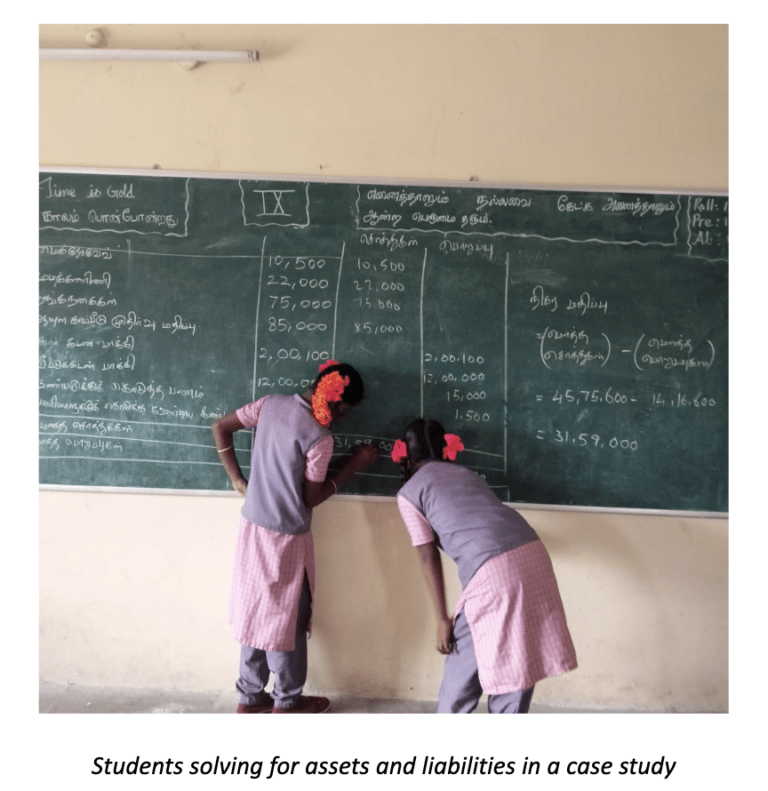

Towards this end, under the District Development Internship Program (DDIP) of the Tiruvallur District collector’s office, Tamil Nadu, we embarked on a pilot project to introduce FE in 14 government schools (one school per block). We partnered with NCFE, a government-backed entity to train teachers, who in turn trained the children. The 3-week campaign was structured using publicly available material in the regional language, which was then logically consolidated into theory and practical sessions.

The one-off campaign was received well by the children, who were excited to perform activities which mirrored the demands of real life, like managing their monthly family budget. At the end of three weeks, about 30 teachers and 840 students were exposed to information that would help them become better money managers.

What merits our attention however, are the multiple challenges in the course of implementation which provide insights for a potential nationwide rollout of FE.

First, not all resources are available in the regional languages. The workbooks designed by NCFE for classes VI to X and its flagship National Financial Literacy Assessment Test (NFLAT) are available only in English and Hindi at present, limiting the scope of the geography of implementation. For the DDIP campaign, SEBI’s limited resources in Tamil proved to be useful. Second, most of the activity-based modules are incomplete, as they don’t come with a solution handbook. This seemingly minor lapse made it hard for the teachers to familiarize with a topic outside their traditional expertise. Third, despite evidence that monetary behavior is largely set by the age seven, NCFE de facto leaves this age cohort (primary school children) out of its purview. Fourth, currently FE is the preserve of those who are aware enough to ask for it. This demand-driven model has led to private schools making up a major chunk of NCFE’s customers, leaving behind government school children.

For a financially aware and empowered India, there is need to revisit the vision, processes and products currently guiding the financial education ecosystem.

- Vision:

- While the National Strategy for Financial Education 2020-25 includes young children in its target audience, the National Education policy 2020 makes only a passing mention of financial literacy under the ‘adult education’ section. We thus need a coherent vision for FE.

- Not only is there a need for coherence in the vision, but also it must be rooted in science. Heckman curve illustrates that the earlier the investment in human capital development, the greater the returns. For instance, in Australia, FE is integrated with the school curriculum for children as young as 5 years of age. Targeting the children of primary schools is thus of paramount importance.

- Processes:

- We must pivot from a demand-driven delivery of financial education to a supply-by-default model. Mainstreaming of financial education would not be possible without the states taking the lead, as they directly control 68.5% of all schools present in India, as per the latest UDISE report. In the USA, 21 states have legislated to mandatorily teach FE in their schools. The recent good news is that all the state boards barring three have agreed to work with the RBI to integrate FE in their curriculum.

- Products

- Being the national lead agency, NCFE’s products will be more accessible if they are available in all the 22 official languages (along with solutions to problems) and are more culture-specific. Greater collaboration between the SCERTs and NCFE can help in curating customized content taking local financial narratives into account. For example in Tamilnadu, the peppy lines of “varavu ettana selavu pathana “ song from the cult movie Bama Vijayam can be effectively used to illustrate that one must live within their means!

Equipping our students with FE is extremely relevant in an era where India’s Fintech sector is offering a wide range of innovative investment avenues. A financially literate society can also keep many social ills like addiction to online gambling and domestic violence at bay. Coherent vision, reformed processes and accessible products in FE will create money-smart individuals whose decisions would ultimately benefit the nation as a whole!