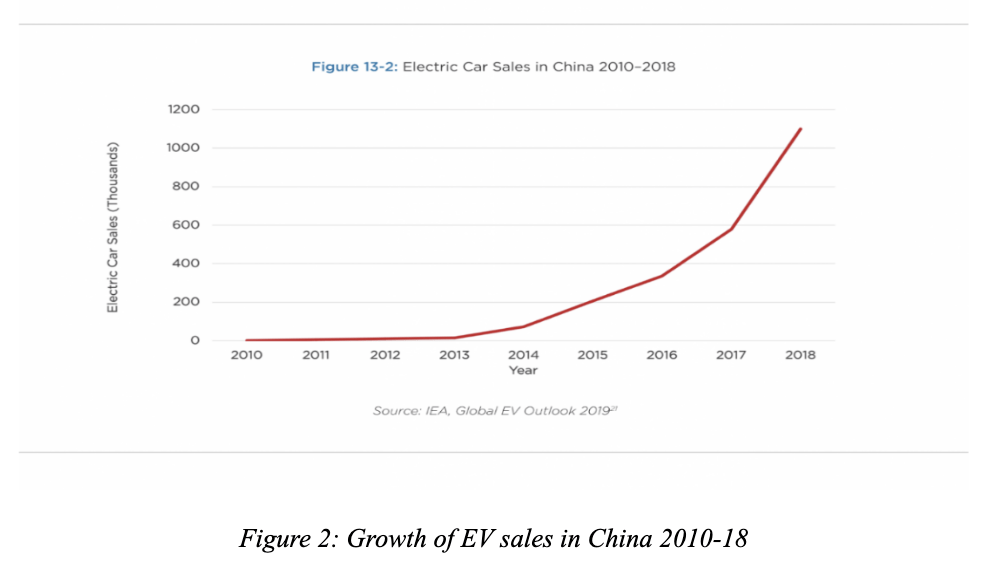

Indian Prime Minister Narendra Modi made a historic announcement at COP26, pledging to cut carbon emissions to net zero by 2070. The decision is a bold step that will require well-defined, evidence-based policy action to achieve tangible results. Over the decades, the engagement on climate change has transformed from being a topic of discussion among the scientific community to a matter of interest among the common public. The lived effects of climate change have made communities and the common populace more active participants in the discourse around green transition. The role of Electric vehicles is central in transitioning to a greener economy and cutting down emissions from fossil fuels. In recent years, the Indian EV market has witnessed fascinating developments with healthy competition among new entrants. According to the latest figures, the Indian electric car market sales volume is 38,000 units in 2022 and is projected to touch 376,000 units by 2030. The governments at the Union and State levels have made policy decisions to support and facilitate the growth of the EV markets in India. The most comprehensive scheme launched by the government of India is FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles in India). Launched in two phases, it initially aimed at demand creation, supporting technology platforms, pilot projects, and the development of charging infrastructure. In its second phase, the scheme increased the subsidies and incentives to promote the adoption of electric vehicles among the public.

The world economy is at the cusp of a remarkable transformation, providing an opportunity for India. The Green economy can become an enabler of growth and job creation in India with the right policies that facilitate market development and investments in the sector. It is essential to analyze global policies adopted by different countries to promote the growth of the EV markets and how they can be adapted to suit the local conditions of the Indian economy.

The Global EV Industry and Market

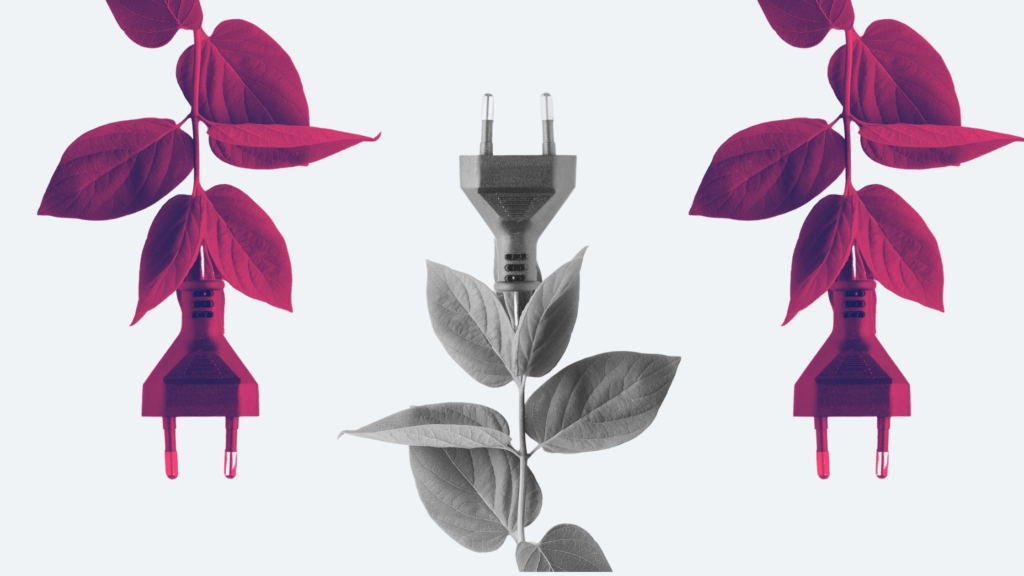

In 2020, global EV sales reached an impressive 3.2 million units, yet accounting for merely 4.2% of the vehicles sold in 2020. There is an urgent need for innovative interventions and measures to accelerate the adoption and reach of electric vehicles. The World Bank research that studied the global diffusion of electric vehicles provides significant and important insights into the various measures adopted by governments and their relative effectiveness. One of the primary policy challenges faced by governments around the world has been the choice between investing in supporting infrastructure (i.e., Charging stations) and subsidizing purchases on the consumer side. In a highly insightful finding, the research shows that investing in charging infrastructure is 4-7 times more cost-effective than providing consumer subsidies. Therefore, the World Bank research, in effect, argues that if the entire money spent on consumer subsidies had been redirected to developing supporting infrastructure, it would have led to a threefold increase in sales. The report explains that the diffusion of EVs in a country like Norway (67%) is much higher than US and China (3-5%) primarily due to the density of charging infrastructure. The study is path-breaking and should become an essential guide for policymaking since most government programs, including India, rely heavily on consumer subsidies. It is also important to note that simple measures, such as the provision of a green license plate, seem to have substantially impacted people’s preferences. It is essential to consider India’s local conditions before blindly accepting the above conclusions and policy recommendations. Therefore, if designed well, short-term consumer subsidies can become a helpful incentive in a market like India, considering the high upfront cost of EVs. The closer study of Chinese policies is extremely important in this context.

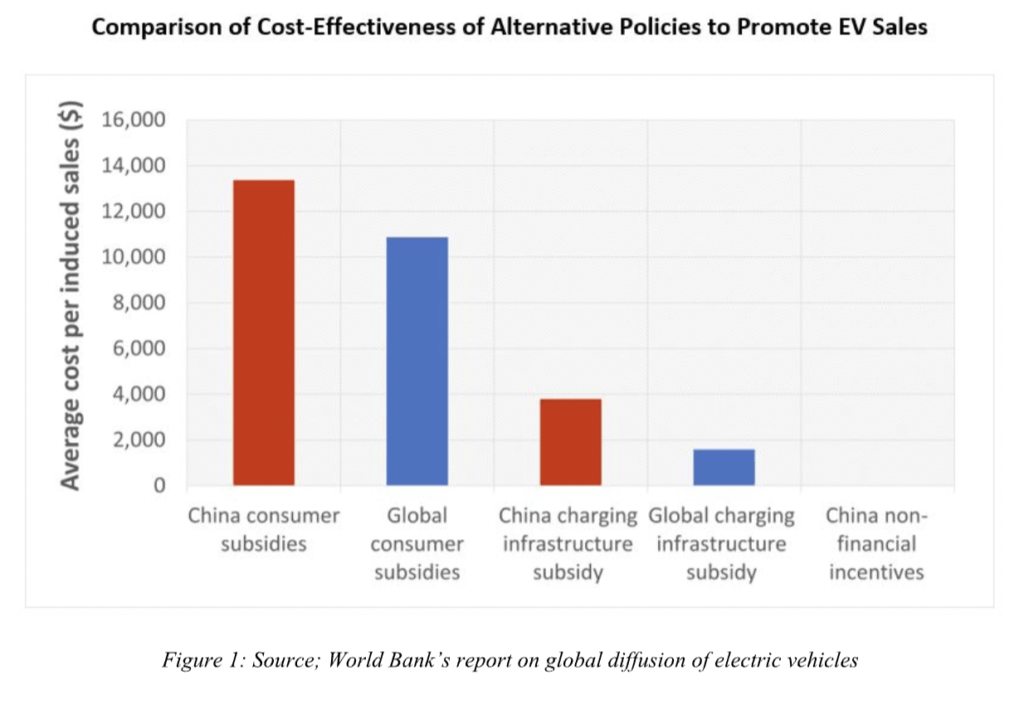

Promising global trends continued in 2021, witnessing a doubling of EV sales, with 6.6 million sold units. According to International Energy Agency’s global electric vehicle outlook for 2022, public spending on incentives and subsidies promoting EVs have touched $30 Billion in 2021. It is important to note that nearly half of this growth came from China. Considering its success, the Chinese EV policy requires closer attention and analysis; it becomes a more critical case study for Indian policymakers.

The Chinese EV Industry and Market

In 2021, China alone accounted for half of the EV units sold globally (3.3 million). The Chinese story of EV promotion requires close study and analysis. While upfront cost and the significant difference with traditional vehicles continue to slow down the diffusion of EVs in most parts of the world, the Chinese story stands unique. The low manufacturing costs have significantly reduced the price gap to merely 10% with traditional fossil fuel-powered vehicles. According to the IEA report, the same is around 45-50% in the western world. Similarly, the Chinese have been much faster in developing charging infrastructure than most parts of the world.

One of the key features of China’s consumer subsidies has been linking them to technological metrics, including mileage per single charge, battery density, system energy efficiency, and charging speed. This innovative linkage indirectly incentivized manufacturers to upgrade their technology without worrying about their product becoming unaffordable for the target market. As discussed earlier, the subsidies are effective only to a certain point and are indeed expensive in relation to the benefits. Therefore, other incentives are significant for developing a sustainable EV market. One of the critical non-subsidy policies adopted by the Chinese is the innovative New Energy Vehicle (NEV) mandate policy. According to the NEV mandate, manufacturers are assigned credits based on mileage per single charge, energy efficiency, etc., and a minimum mandatory credit requirement is set for the manufacturers. The Chinese government also uses simple incentives such as special license plates, traffic restrictions, and dedicated parking spaces to promote the adoption of EVs. These credits can further be traded by companies amongst each other, whereby further incentivizing innovation.

In a critical policy decision, the Chinese government has been redirecting the amounts saved from reduced subsidies to developing charging infrastructure. According to the Electric Vehicle Charging Infrastructure Development Guidelines of 2015, the charging outlets per EV should be a minimum of 1:7 in key cities by 2020. By 2019, China had built more than 516 thousand EV charging outlets. The Chinese have also been active in ensuring the transition of public transport systems to EVs. According to a study by Evergrande Research Institute, 46.1% of all NEVs sold in China were procured by the public sector. The Chinese states also played a critical role in supporting the central government with their innovative initiatives to promote EV adoption.

In summary, China used a mixture of infrastructure investments, measures to incentivize manufacturers, public procurements to ensure initial demand, and short-term consumer subsidies to become a global leader in EVs.

Future of the EV industry and Market in India

India, which is currently transitioning towards green technology, can profit from the rich experience of countries that have tried and implemented policies in the last decade. One of the significant steps taken by the government of India in recent times is the performance-linked incentive scheme (PLI). The PLI Scheme provides manufacturers incentives to boost domestic manufacturing in the country. Under the scheme, up to 18% incentive is provided based on the incremental turnover of a company. The government has an ambitious target of raising 42,000 crores in investments within the EV space; thanks to the PLI scheme. The scheme differs from the FAME scheme discussed earlier since this focuses on building a more robust supply chain and promoting manufacturing.

India continues to be a lucrative destination for investors since it is among the largest markets in the world. Currently, 20 million two-wheelers are sold annually in India before the pandemic. According to projections, the penetration of two-wheelers is expected to rise to 37-42% by the financial year 2031. The PLI scheme can attract and facilitate investments in the space and can motivate companies to work on capacity building and developing the latest technology. The government of India also launched the e-Amrit portal in 2021 as a one-stop destination for all information and details related to electric vehicle policies, subsidies, etc. The portal is vital to disseminate information among potential investors and companies.

The transition of public transportation systems to EVs successfully boosts demand and encourages manufacturers, as the Chinese example clearly indicates. It will create an initial demand for EVs and boost investments while also significantly cutting emissions from old public transport vehicles. A comprehensive mobility plan for significant cities is a fine starting point to begin the EV adaptation. The city governments, i.e., Corporations and municipalities, have a substantial role in this transition.

The International Energy Agency provides five key recommendations to accelerate the uptake of EVs, which can provide a blueprint for policymaking in India too:

- The reliance on direct subsidies should be slowly brought down while promoting EV adoption more sustainably. While the IEA proposes stringent emission standards as an alternative, the Chinese credit system is another method of non-subsidy promotion of EVs.

- The IEA calls for the promotion of heavy-duty electric models such as electric buses and trucks. A policy-led transition in the heavy models can significantly impact demand formation and reducing emissions.

- IEA recommends prioritizing two-three wheelers and urban buses in developing countries.

- The most important recommendation is the expansion of EV infrastructure. As multiple studies show, the availability of public charging infrastructure is primary for EV markets to thrive in any country.

- The development of sustainable and resilient supply chains is necessary to ensure the sector’s long-term growth. The EV industry still needs to address the long lead times in the extraction and processing of raw materials. The governments to step in to promote investments in raw material extractions to ensure smooth supply chains. Only when supply chains are smooth will manufacturer confidence rise, and thereby more investments will flow into the sector.

India is among the markets with the maximum potential to become a global leader in EV manufacturing and green technology. With the Indian demographic advantage and presence of a large consumer market, it is uniquely positioned to make the best out of the opportunity. As the world economy moves towards a critical transformation, with the right policies, India can both boost its economic growth and simultaneously create well-paying jobs. The Indian government’s initiatives, such as FAME, PLI, and the green hydrogen mission, are steps in the right direction. It is essential for our policymakers to closely observe the successful models in other countries and thereby make evidence-backed decisions while India moves towards its climate commitment of net zero in 2070.